The conversation at a recent Sotheby's evening sale revealed everything about how the art market has evolved. A Silicon Valley entrepreneur stood alongside a Swiss private banker, both examining the same Gerhard Richter abstraction. "I diversified out of tech stocks last quarter," the entrepreneur mentioned quietly. "Contemporary blue-chip art has outperformed my portfolio consistently since 2020." The banker nodded knowingly. "My clients have been asking about art allocation for years. The data finally supports what collectors have understood intuitively—certain artists represent exceptional stores of value."

This exchange captures a fundamental shift occurring in wealth management circles worldwide. Blue-chip art—works by established masters whose market presence has proven resilient across decades—has transitioned from a passion-driven pursuit into a recognized asset class deserving serious portfolio consideration. For collectors entering this space in 2026, the opportunity combines cultural enrichment with financial prudence in ways that few alternative investments can match.

[Image Placement 1: Auction house evening sale scene with spotlight on contemporary masterwork]

Yet navigating the blue-chip art market requires knowledge that extends far beyond simply recognizing famous names. Understanding what transforms an artist into a blue-chip investment, where strategic entry points exist, and how to build relationships within this insular world separates successful collectors from enthusiastic amateurs who overpay for mediocre works. This guide provides the framework that sophisticated collectors use to identify opportunities, evaluate quality, and construct portfolios that appreciate steadily while enriching daily life.

Decoding "Blue-Chip": What Separates Market Leaders from the Rest

The term "blue-chip" originates from poker's highest-value chips, and in art collecting, it describes artists whose market positions have achieved sustained institutional validation. But this definition requires unpacking, because not every expensive artist qualifies as blue-chip, and some blue-chip artists remain surprisingly accessible for new collectors.

The Five Pillars of Blue-Chip Status

True blue-chip artists demonstrate all five characteristics simultaneously. Museum representation forms the foundation—major permanent collections at institutions like MoMA, Tate Modern, Centre Pompidou, or the Metropolitan Museum establish cultural legitimacy that transcends market fluctuations. When the Guggenheim acquires an artist's work, they're making a multi-generational statement about historical importance.

Auction performance history provides the second pillar. Blue-chip artists show consistent results across multiple auction houses over extended periods, typically decades. A single record-breaking sale means little; sustained demand at major evening sales year after year indicates deep collector interest. Georg Baselitz, for instance, has maintained an auction presence since the 1970s, with works regularly achieving seven-figure results regardless of broader economic conditions.

Critical consensus represents the third requirement. Blue-chip artists receive serious scholarly attention—monographs from respected art historians, retrospectives at major museums, and inclusion in definitive survey texts. This intellectual framework provides the cultural scaffolding that justifies market values and ensures continued relevance to future generations of collectors and institutions.

The fourth pillar involves gallery representation. Blue-chip artists typically show with top-tier galleries in multiple international markets—think Gagosian, Hauser & Wirth, David Zwirner, White Cube, Pace. This network ensures global market access and professional management that maintains market stability even during economic turbulence.

Finally, secondary market liquidity distinguishes blue-chip investments from mere collectibles. When you need to sell a Lucian Freud painting, multiple auction houses compete for the consignment, dealers make immediate offers, and collectors queue to preview. This liquidity provides the exit strategy that transforms art from an expense into an asset.

The Blue-Chip Hierarchy: Understanding Market Tiers

Within the blue-chip category, distinct tiers exist with different risk-return profiles. Ultra blue-chip artists—Picasso, Warhol, Basquiat, Monet, Rothko—command eight-figure prices and attract institutional buyers, billionaire collectors, and sovereign wealth funds. These works function like gilt-edged bonds: stable, prestigious, but with modest appreciation potential relative to entry cost.

Established blue-chip artists occupy the sweet spot for sophisticated collectors building serious holdings. Artists like Anselm Kiefer, Cecily Brown, Julie Mehretu, and Christopher Wool have proven track records, major institutional support, and works available from $500,000 to $5 million—significant investments that remain within reach for successful professionals and family offices.

Emerging blue-chip artists represent the most dynamic opportunity. These are mid-career artists with strong institutional validation, rising auction results, and top gallery representation, but whose markets haven't yet reached full maturity. Artists like Christina Quarles, Salman Toor, or Jadé Fadojutimi showed 50-150% appreciation between 2022 and 2025 as their markets developed critical mass.

Understanding these tiers helps collectors match acquisition strategy to financial goals and risk tolerance. An ultra blue-chip Warhol provides prestige and stability; an emerging blue-chip Quarles offers growth potential with greater volatility.

Entry Points: Where Strategic Collectors Begin

The common misconception holds that blue-chip collecting requires eight-figure budgets. While trophy pieces command spectacular prices, strategic entry points exist across the value spectrum for collectors who understand market structure.

Works on Paper: The Sophisticated Collector's Secret

Drawings, prints, and works on paper by blue-chip artists offer the most accessible entry point without compromising quality or investment potential. A Gerhard Richter overpainted photograph might cost $80,000 versus $8 million for a comparable painting. Yet it carries identical provenance, similar aesthetic impact, and the same cultural cachet among knowledgeable collectors.

David Hockney's iPad drawings, released as editions through Taschen, brought works by one of Britain's most celebrated living artists to collectors at $2,500-$10,000 price points. While edition works appreciate more slowly than unique pieces, they provide authentic exposure to an artist's practice and often outperform traditional investments. Hockney iPad prints from 2010 now trade at 300-400% premiums on the secondary market.

Works on paper also offer portfolio diversification within a single artist's oeuvre. A collector might acquire a Cy Twombly drawing for $200,000 while his paintings exceed $20 million. This strategy provides market exposure with manageable capital commitment and superior liquidity when selling becomes necessary.

Edition Works and Multiples: Understanding the Nuances

Blue-chip artists frequently produce limited edition prints, sculptures, or multiples that democratize access while maintaining artistic integrity. But not all editions are created equal, and understanding the distinctions separates informed acquisitions from poor value.

Artist-approved editions produced during the artist's lifetime with their direct involvement represent the gold standard. When Jeff Koons personally oversees production of a limited edition sculpture through a respected fabricator, these works carry comparable cultural weight to his unique pieces—they're simply manufactured in controlled quantities. Damien Hirst's spot paintings exist as both unique works and editions, with editions trading actively between $50,000-$200,000 depending on size and year.

Posthumous editions require more scrutiny. While estates sometimes produce editions using the artist's original designs and intentions, other posthumous releases feel opportunistic. A Picasso estate-approved ceramic from the 1960s carries more legitimacy than a posthumous print edition released in 2023 to capitalize on market demand.

Edition size matters profoundly. Editions of 10-25 maintain scarcity and typically appreciate steadily. Once editions exceed 100 copies, they function more as collectibles than investments, though they still provide authentic ownership of an important artist's work.

Secondary Market Opportunities: Finding Value in Established Works

Patient collectors discover that the secondary market—works being resold by previous owners—often provides better value than primary market acquisitions from galleries. At auction, works sometimes sell below estimate when facing temporary market headwinds, cataloging errors, or simple auction timing issues.

A sophisticated collector might acquire a Frank Stella painting at auction for $400,000 that would cost $600,000 through a gallery, simply because the auction occurred during August, when major collectors vacation and bidding competition decreases. The work's intrinsic quality remains identical; the price reflects temporary market dynamics.

Gallery secondary market sales offer another avenue. Major galleries maintain "private sale" departments that broker previously owned works between collectors. These transactions provide discretion, expert authentication, and often negotiable pricing that auction guarantees and buyers' premiums eliminate.

Evaluating Artists and Works: The Collector's Due Diligence Framework

Acquiring blue-chip art successfully requires systematic evaluation that examines both the artist's market position and the specific work's quality within their oeuvre. Experienced collectors develop frameworks that assess multiple factors before committing significant capital.

Artist Market Analysis: Reading the Signals

Begin by examining an artist's auction history trajectory. Visit Artnet, Artprice, or auction house databases to chart hammer prices over 10-20 years. Healthy blue-chip markets show steady appreciation with occasional plateaus—never parabolic spikes followed by crashes. When an artist's auction results suddenly triple in 18 months, that signals speculation rather than sustainable demand.

Institutional acquisition patterns provide crucial validation. Track which museums have acquired the artist's work in recent years. When the Whitney Museum, LACMA, and Tate all acquire different works by the same artist within a three-year window, major curators are signaling confidence in long-term historical importance.

Gallery representation changes merit attention. Artists moving from mid-tier galleries to mega-galleries like Gagosian or Pace often see corresponding price increases as the new gallery's client base drives demand. Conversely, artists switching galleries frequently or losing representation at major houses raise red flags about market stability or difficult personalities that complicate long-term value.

Critical reception balance matters more than simple acclaim. An artist receiving thoughtful criticism in Artforum, October, and The Burlington Magazine alongside popular coverage in Vogue or Financial Times demonstrates both scholarly respect and cultural relevance—the combination that sustains blue-chip status across decades.

Artwork-Specific Quality Assessment

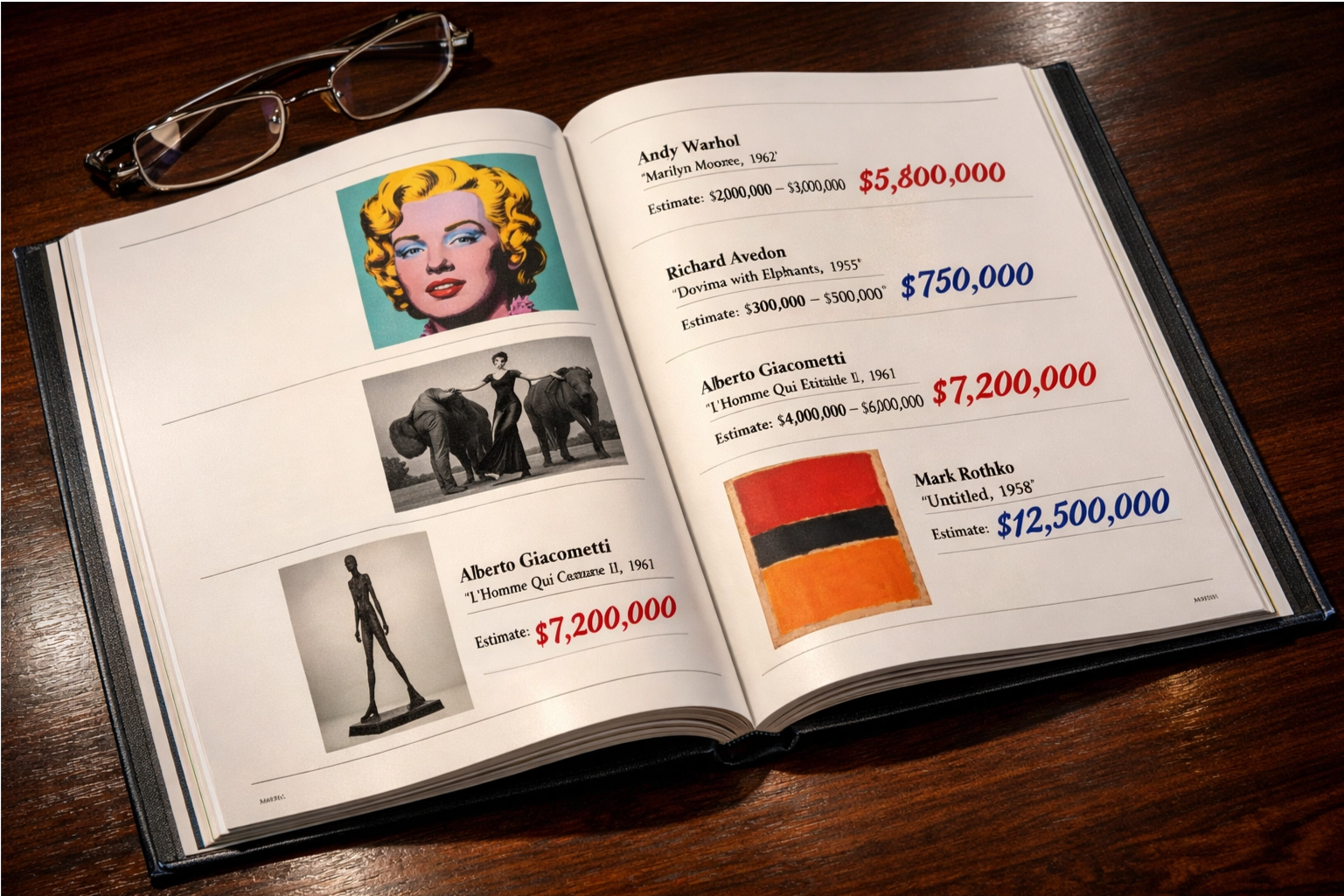

Within any artist's body of work, individual pieces vary dramatically in investment potential. Iconic imagery commands premiums—a Warhol Marilyn will always outperform a generic flower print, even though both are "authentic Warhols." Understanding which subjects, techniques, or periods represent an artist's most coveted work prevents overpaying for lesser examples.

Condition assessment requires professional expertise. Engage a qualified conservator to examine any work before acquisition. A painting with subtle restoration might appear perfect to untrained eyes while suffering a 30% value reduction compared to pristine examples. Conservation reports provide crucial negotiating leverage and protect against expensive surprises after purchase.

Provenance quality increasingly impacts value. Works with distinguished collection histories—previously owned by major collectors, exhibited at important museums, or published in scholarly literature—carry provenance premiums that reflect enhanced cultural significance. A painting owned sequentially by prominent collectors and loaned to major exhibitions tells a story that enhances both prestige and market value.

Scale and presentation influence acquisition decisions. Among blue-chip contemporary artists, larger works typically outperform smaller pieces because they suit museum walls and major private collections. A 6x8-foot Anselm Kiefer painting might appreciate 50% faster than a 3x4-foot example simply due to presentation impact and institutional collection suitability.

Acquisition Channels: Navigating Galleries, Auctions, and Private Sales

Where you acquire blue-chip art significantly impacts price, authenticity assurance, and future market access. Sophisticated collectors develop strategies that leverage different channels' unique advantages while avoiding their pitfalls.

Gallery Relationships: The Long Game

Acquiring important works from top-tier galleries requires understanding that you're building relationships, not simply making purchases. Major galleries operate waiting lists for coveted artists—collectors might wait years for allocation of a new Jeff Koons or Yayoi Kusama work. But this system rewards loyalty and collecting depth.

Building gallery credibility begins with smaller acquisitions that demonstrate serious intent. A collector might purchase several $50,000-$100,000 works by gallery-represented emerging artists, attend exhibition openings, and engage meaningfully with directors before receiving offers for major blue-chip pieces. Galleries reward collectors who support their full roster rather than cherry-picking only the most famous names.

Primary market advantages include guaranteed authenticity, pristine condition, and access to works before public market competition drives prices higher. When Julie Mehretu releases new paintings through Marian Goodman Gallery at $800,000, auction results two years later often reach $1.2-1.5 million—galleries provide first access at controlled pricing.

The primary market also offers payment flexibility that auctions rarely provide. Galleries might accept installment payments over 12-24 months for seven-figure acquisitions, smoothing cash flow impact for collectors managing diversified portfolios.

Auction Strategy: When Competition Creates Opportunity

Major auction houses—Christie's, Sotheby's, Phillips—bring transparency, market validation, and occasional bargains that gallery relationships cannot provide. Understanding auction dynamics transforms this channel from an intimidating spectacle into a strategic acquisition opportunity.

Pre-auction research separates successful bidders from impulsive overpayers. Study the complete catalog, attend previews, request condition reports, and research comparable sales. Establish maximum bids before entering the salesroom based on rational valuation, not emotional reaction to competitive bidding.

Auction guarantees have transformed high-end sales into hybrid transactions. When auction houses provide guaranteed minimum prices to consignors, they're effectively purchasing the work themselves and reducing downside risk. For bidders, this means works with guarantees carry institutional validation—the auction house's experts valued the piece sufficiently to commit their own capital.

Post-sale negotiations represent an underutilized strategy. Works that pass (fail to sell) at auction often become available through private treaty sales at below-estimate pricing. Contact the auction house's private sales team within days of a sale to inquire about passed lots that interest you—many sell quietly at 15-25% discounts versus public estimates.

Private Sales and Art Advisors: Accessing the Hidden Market

An estimated 50-60% of blue-chip art transactions occur privately, never appearing in public auction results or gallery announcements. This discreet market offers both opportunities and risks for collectors navigating without expert guidance.

Art advisors provide access to this hidden market while protecting collectors from overpaying or purchasing problematic works. Experienced advisors maintain relationships across galleries, auction houses, estates, and private collectors, learning about available works before public knowledge. Their fees—typically 5-10% of purchase price—pay for expertise, access, and advocacy that solo collectors cannot replicate.

Direct collector-to-collector sales sometimes offer exceptional value when sellers prioritize speed and discretion over maximum price. A collector relocating internationally might accept $2 million for a painting that would fetch $2.3 million at auction simply to avoid the public market process and receive immediate payment. Advisors facilitate these transactions while managing authentication, condition verification, and legal documentation.

Estate sales represent another private market channel with unique dynamics. When collectors pass away, estates often sell holdings discreetly to avoid flooding markets or public family disputes. Advisors with estate relationships can acquire important works at reasonable valuations before works reach competitive auction or gallery channels.

Building a Diversified Blue-Chip Portfolio

Acquiring individual masterpieces represents only the first step toward constructing a collection that appreciates steadily while providing cultural enrichment and portfolio diversification. Sophisticated collectors think systematically about how works relate to each other and to broader investment goals.

Portfolio Architecture: Balancing Risk and Cultural Coherence

Financial advisors recommend that art represent 5-15% of investable assets for high-net-worth individuals, with blue-chip works forming the portfolio foundation. Within art allocation, consider diversifying across multiple dimensions that balance risk while maintaining aesthetic coherence.

Era diversification protects against period-specific market fluctuations. A portfolio might include Post-War masters (Rothko, de Kooning), contemporary blue-chips (Kiefer, Richter), and emerging blue-chips (Quarles, Toor). This temporal spread ensures that your collection isn't vulnerable to single market segment corrections.

Medium diversification offers similar protection. Paintings typically command the highest prices and strongest appreciation, but photographs, sculptures, and works on paper provide portfolio balance at different price points. Irving Penn photographs ($50,000-$200,000) offer blue-chip photography exposure without painting-level capital commitment.

Geographic diversity matters increasingly as Asian and Middle Eastern markets mature. A collection weighted entirely toward Western artists might miss appreciation trends driving demand for Asian contemporary artists like Yoshitomo Nara or Ayako Rokkaku, whose markets have surged 200-400% since 2020 as institutional validation expands.

Yet diversification must serve aesthetic vision, not just financial optimization. Collections with thematic coherence—abstractionism across generations, female artists breaking barriers, or post-colonial perspectives—provide both intellectual satisfaction and market advantages. Coherent collections attract institutional exhibition opportunities that enhance provenance and value.

The Luxury Collecting Nexus: Art, Watches, Cars, and Wine

Sophisticated collectors increasingly recognize that different collectible categories share market dynamics, wealth preservation characteristics, and lifestyle integration that make cross-category diversification both personally enriching and financially prudent.

Watches and art particularly overlap in collecting psychology and market structure. Both feature blue-chip categories (Patek Philippe parallel to Picasso), require authentication expertise, and combine cultural significance with investment potential. Collectors who understand Rolex Daytona scarcity principles easily grasp similar dynamics in Basquiat's market. Many top galleries and auction houses now operate dedicated watch departments serving clients who collect across categories.

Classic automobiles share provenance importance, condition sensitivity, and appreciation potential with fine art. The same collector willing to spend $2 million on a Gerhard Richter painting might invest identically in a 1961 Ferrari 250 GT SWB—both represent museum-quality examples of their creators' most important work, both require specialist conservation, and both provide tangible enjoyment alongside financial appreciation.

Fine wine complements art collecting through similar market structures and wealth preservation characteristics. Collectors often store wine and art in the same climate-controlled facilities, insure both through specialist providers, and view both as lifestyle assets that appreciate while providing regular enjoyment. The discipline required to cellar Bordeaux first growths for 20 years mirrors the patience successful art collecting demands.

Cross-category collecting creates portfolio resilience through imperfect correlation. When contemporary art markets soften, watch or wine markets might surge, smoothing overall alternative investment returns. But more importantly, this approach enriches daily life with beautiful objects that happen to appreciate rather than pure financial assets that provide only returns.

Authentication, Provenance, and Legal Protections

Blue-chip art collecting's financial stakes demand rigorous authentication protocols and legal protections that casual collecting doesn't require. Understanding these frameworks protects collectors from fraud, forgery, and disputes that can devastate both finances and reputation.

Authentication Infrastructure

Before acquiring any blue-chip work, engage appropriate authentication resources. Many important artists maintain catalogue raisonné projects—comprehensive scholarly records of all known authentic works. Contact the relevant catalogue raisonné committee before purchase to verify inclusion or request authentication. Works excluded from catalogues raisonnés face severe market penalties regardless of apparent quality.

Artist estates and foundations maintain authentication boards for deceased artists. The Andy Warhol Authentication Board, Basquiat Authentication Committee, and similar organizations provide opinions on works' authenticity. While some boards have controversial histories or have ceased operations due to litigation risks, those still functioning provide crucial market validation.

Scientific analysis increasingly supplements connoisseurship-based authentication. Techniques including pigment analysis, canvas dating, X-radiography, and infrared reflectography can identify anachronistic materials or reveal hidden compositional changes that affect attribution. Major auction houses routinely conduct scientific analysis on high-value lots; private collectors should demand similar scrutiny.

Conservation examinations by qualified professionals reveal condition issues, previous restoration, and structural concerns that impact value and authenticity assessments. Never rely on sellers' descriptions—engage your own conservator to produce independent condition reports before finalizing purchases.

Provenance Documentation and Due Diligence

Complete provenance—documented ownership history from creation to present—protects against stolen art claims, title disputes, and authentication questions while enhancing market value. Sophisticated collectors insist on comprehensive documentation before acquisition.

Gallery invoices, auction records, and exhibition catalogs provide primary provenance evidence. Works exhibited at major museums and published in scholarly literature carry enhanced provenance that justifies premium pricing. Conversely, works with gaps in ownership history or unclear title raise questions that suppress values regardless of aesthetic quality.

Due diligence searches through databases, including Art Loss Register, Interpol's stolen art database, and holocaust-era asset registries, protect against acquiring looted or stolen works. While auction houses conduct these searches automatically, private transactions require collectors to perform independent verification or face potential seizure and restitution claims years after purchase.

Import/export documentation matters increasingly as governments tighten cultural property regulations. Verify that works can legally export from current locations and import to intended destinations. Works that cannot travel internationally face severe liquidity constraints that impact long-term value.

Legal Frameworks and Acquisition Structures

High-value art acquisitions merit legal sophistication matching the financial commitment. Purchase agreements should specify warranties regarding authenticity, title, condition, and legal export status. Include contractual remedies if works prove inauthentic or encumbered by claims, including full refund rights and seller-paid legal costs.

Acquisition entities provide privacy, tax optimization, and liability protection. Many collectors purchase art through LLCs, trusts, or private foundations rather than personally. These structures offer estate planning advantages, potential tax deductions for museum loans, and insulation from personal liability if authenticity disputes arise.

Insurance requirements increase dramatically in blue-chip collecting. Specialized art insurance policies provide agreed-value coverage, worldwide protection during transport and loans, and access to conservation networks if damage occurs. Annual premiums typically run 0.1-0.2% of collection value—modest protection for seven-figure holdings.

Tax Considerations and Strategic Planning

Blue-chip art collecting involves complex tax implications that sophisticated collectors manage proactively through strategic planning rather than reactive compliance.

Acquisition Tax Strategies

Sales tax avoidance through legitimate structures can save 6-10% on major purchases. Many U.S. collectors form Delaware LLCs or Montana entities to purchase art, avoiding sales tax in states with aggressive collection enforcement. Works remaining in tax-free storage facilities (Delaware, Singapore, Geneva) are legally deferred from sales tax liability indefinitely.

Use tax obligations require attention when acquiring works outside your primary residence state. Most states impose use taxes on out-of-state purchases brought into the state, though enforcement varies dramatically. Collectors should work with tax advisors to understand reporting obligations and structure acquisitions to minimize exposure.

Appreciation and Capital Gains Management

Art held over one year qualifies for long-term capital gains treatment, but at a 28% maximum federal rate versus 20% for securities—the "collectibles tax rate" that penalizes alternative investments. This rate differential means that art must appreciate 40% more than stocks to produce equivalent after-tax returns, making holding periods and appreciation potential crucial considerations.

Tax-loss harvesting opportunities arise when works decline in value. Selling depreciated pieces to realize losses that offset other capital gains provides tax efficiency while allowing repurchase of similar works after the 30-day wash sale rule period. Unlike securities, art's unique nature makes wash sale rules easier to navigate.

Charitable donation strategies offer powerful tax advantages for appreciated works. Donating art to qualifying museums provides fair market value deductions (not just cost basis) while eliminating capital gains liability. A painting purchased for $500,000 and valued at $2 million when donated generates a $2 million charitable deduction while avoiding $420,000 in capital gains taxes—creating $980,000 in tax benefits from a $500,000 investment.

Estate Planning Integration

Art requires specialized estate planning because collections often represent significant wealth concentrated in illiquid, indivisible assets. Fractional ownership structures allow collections to be distributed among heirs while avoiding forced sales to pay estate taxes. Family LLCs or partnerships hold collections with heirs receiving membership interests rather than specific artworks, providing liquidity and valuation flexibility.

Strategic loans to museums during life create documented institutional validation that supports estate valuations while building relationships with museums that might acquire works after death. These relationships sometimes yield lifetime acquisition commitments that provide estates with guaranteed institutional buyers at fair market values.

The Artestial Advantage: Streamlining Blue-Chip Art Acquisition

Navigating blue-chip art markets demands expertise, access, and infrastructure that few collectors possess independently. Artestial.com provides the comprehensive platform that sophisticated collectors require to identify opportunities, conduct due diligence, and acquire museum-quality works with confidence.

Our curated marketplace features authenticated blue-chip works across all price points, from accessible editions to museum-quality masterpieces. Every listing includes comprehensive provenance documentation, condition reports from qualified conservators, and transparent pricing that reflects current market conditions. Unlike traditional galleries, where pricing remains opaque and access depends on relationships, Artestial democratizes blue-chip collecting through technology while maintaining the expertise and service standards that major acquisitions demand.

Beyond the marketplace, Artestial's advisory services connect collectors with specialists who provide personalized guidance throughout the acquisition process. Whether you're making your first blue-chip purchase or adding to an established collection, our advisors offer authentication verification, market analysis, acquisition negotiation, and post-purchase support, including conservation, insurance, and installation planning.

Conclusion: Building Legacy Through Intelligent Collecting

Blue-chip art collecting represents far more than financial diversification or status signaling. At its finest, collecting builds cultural legacy—preserving humanity's greatest creative achievements while supporting living artists whose work will enrich future generations. That a well-constructed collection also appreciates steadily makes collecting one of the few pursuits where financial prudence and cultural contribution align perfectly.

The collectors who succeed in this space share common characteristics: patience to build relationships and wait for the right works, discipline to pass on mediocre examples regardless of brand names, and curiosity to continuously educate themselves about art history, market dynamics, and emerging talent. They view collecting as a multi-decade journey rather than a series of transactions, understanding that the most meaningful collections develop organically through sustained engagement with art, artists, and the institutions that preserve cultural heritage.

For collectors ready to begin this journey, 2026 offers an exceptional opportunity. Market corrections in 2022-2023 created entry points at valuations unseen in years, while museums and galleries emerge from pandemic disruption with renewed energy and ambitious programming. The infrastructure supporting serious collecting—from authentication services to specialized insurance to digital provenance platforms—has never been more sophisticated or accessible.

Whether you're acquiring your first blue-chip work or adding to a multi-generational family collection, approach each acquisition with the seriousness it deserves. Engage expert advisors, conduct thorough due diligence, and maintain patience in seeking works that genuinely resonate aesthetically while meeting rigorous quality standards. The art market rewards informed, disciplined collectors who understand that true blue-chip status reflects not just current prices but cultural significance that endures across generations.

The masterpieces you acquire today will hang in your home, enrich your daily life, and—if chosen wisely—appreciate steadily while representing humanity's creative achievement at its finest. That's an investment thesis that transcends mere financial returns.

Frequently Asked Questions

How much capital do I need to start collecting blue-chip art seriously?

Meaningful blue-chip collecting can begin at $50,000-$100,000 for works on paper or edition sculptures by established artists. At $250,000-$500,000, collectors access unique works by emerging blue-chip artists or significant editions by ultra blue-chip names. Budgets exceeding $1 million open doors to established blue-chip paintings and major contemporary works. However, successful collecting depends more on knowledge and patience than pure capital—a carefully chosen $75,000 drawing can appreciate more dramatically than an ill-considered $750,000 painting.

Should I focus on a single artist or diversify across multiple artists?

Portfolio theory suggests diversification across multiple artists, periods, and mediums reduces risk while maintaining appreciation potential. However, focused collections of a single artist (or a tight group of related artists) can develop exceptional provenance and exhibition histories that enhance value. Many collectors begin by diversifying broadly, then concentrate holdings as expertise and aesthetic preferences develop. There's no universal rule—align strategy with personal passion, financial goals, and collection scope.

How do I know if a work is properly priced, or if I'm overpaying?

Compare asking prices to recent auction results for similar works using Artnet, Artprice, or auction house databases. Consider size, medium, date, subject matter, and condition when evaluating comparables. Works from galleries typically carry 15-30% premiums versus auction hammer prices due to guarantees, payment flexibility, and curation services. If asking prices exceed recent comparables by more than 40%, negotiate or walk away. Remember that "fair market value" represents the price at which willing buyers and sellers transact—not simply what sellers want.

What percentage of my investment portfolio should I allocate to art?

Financial advisors typically recommend 5-15% alternative asset allocation for high-net-worth individuals, with art comprising a portion of this allocation alongside watches, wine, classic cars, or private equity. Art's illiquidity, transaction costs (buyer's premiums, insurance, conservation), and uncertain appreciation timelines make it unsuitable for emergency funds or short-term capital needs. Only invest capital you can afford to have locked up for 5-10+ years while enjoying the works aesthetically, regardless of financial performance.

How do I sell blue-chip art when I'm ready to exit positions?

Blue-chip works offer multiple exit channels. Major auction houses compete for quality consignments during evening sales, providing transparent pricing and wide buyer access—expect 10-25% total fees between seller's commission and buyer's premium. Galleries sometimes buy back works directly or broker private sales for 10% commissions. Art advisors can discreetly market works to their client networks. The strongest works by the most established artists sell quickly at fair prices; lesser examples or works by temporarily unfashionable artists may require patience and strategic pricing to achieve successful sales.

Ready to begin your blue-chip collecting journey? Explore Artestial's curated selection of museum-quality works from established masters and emerging talents, or connect with our advisory team for personalized guidance on building a collection that enriches your life while appreciating steadily.

Curating excellence, one insight at a time.— The Scene

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or tax advice. Art markets fluctuate based on multiple factors, including economic conditions, collector preferences, artist reputation, and market trends. Past performance does not guarantee future returns. Authentication, insurance, storage, conservation, and transaction costs significantly impact net returns. Tax implications vary by jurisdiction and individual circumstances. Consult qualified financial advisors, tax professionals, and art specialists before making significant investment decisions. Observations reflect industry knowledge as of early 2026 and may not apply to specific situations.